Top sellers

VAT number

Invoice tax-free foreign business customers who have a valid VAT number on VIES after verifying the VAT numbers to avoid VAT scams and customer errors.

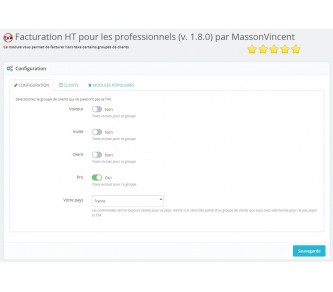

Invoicing HT (without VAT) for pros (1.6 &...

This module allows you to invoice the groups of customers of your choice excluding VAT and to connect to customer accounts without knowing their password (superuser) in order to check the result.

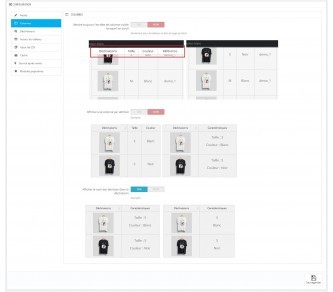

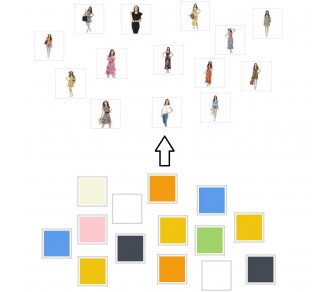

List of combinations

Display the list of variations on different pages to make more visible the richness of your products by the number of variations with the list of attributes, the image of each declination, a direct link to the declination and especially a button to add the declination directly into the cart !

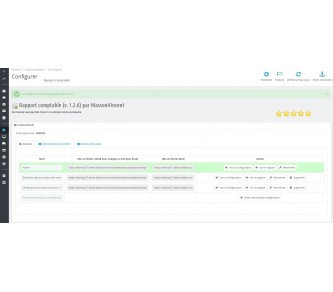

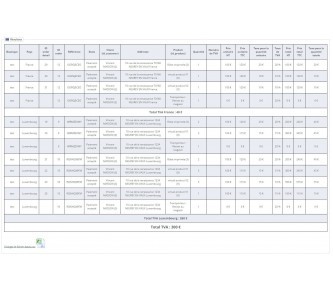

Accounting summary with VAT

This module allows you to have a complete accounting report, which not only allows you to give a CSV file listing the sales over a given period to your accountant,but also allows you to analyze your sales by sorting the data by profit, unit profit in order to see the most profitable and least...

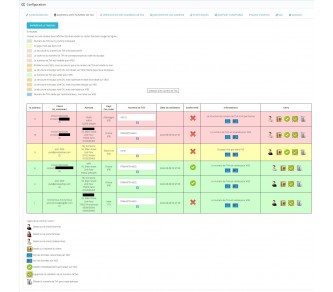

Delivery zones and postal codes

This module makes it possible to "divide" a country into new zones (regions, departments, postal codes ...) in order to allocate for each zone a specific carrier (or several) with a specific tariff.

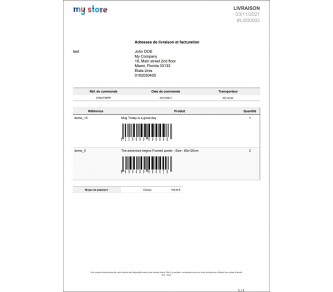

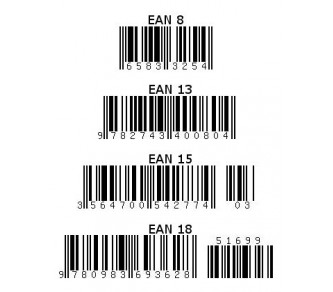

EAN bar code 8, 13, 15, 18

Do your products and combinations have an EAN? then display the bar code corresponding to this EAN (8, 13, 15 or 18) on your store, invoices, delivery slips and update the stocks of these products very easily and very quickly from the configuration of the module.

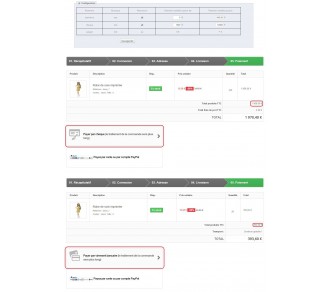

Restriction of modes of payments based on the...

This module allows you to limit the list of payment methods depending on the amount of the customer's cart.

Images thumbnails

Improve the rendering of presentation of products by replacing the squares of colours of the attributes by thumbnails.

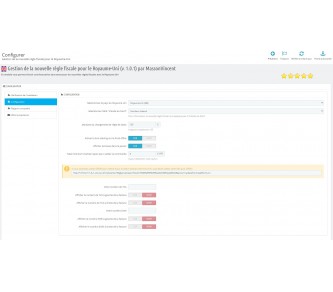

Management of VAT (MOSS)

This module allows you to account for VAT with maximum ease by displaying VAT for each product for each order based on the saved settings. This module is optimized for MOSS ("mini one-stop shop"), the VAT returns of dematerialized products purchased by non-professional clients.

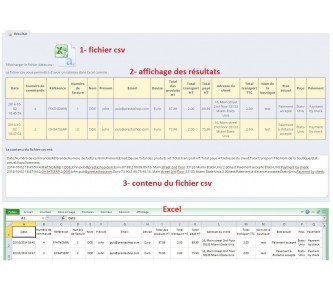

Export of invoices

You want to analyze your sales? then export your bills with more than 50 parameters regarding the invoice, customer, payment, shipping...

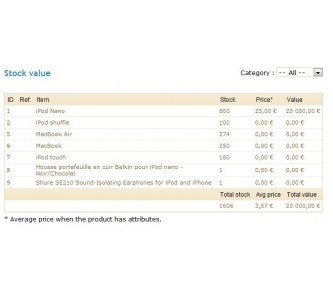

Valorisation du stock

You will be able to edit your complete accounting reports of the value of the stock you have, by product and / or class, based on the purchase price, excluding tax, your products from your suppliers.

New VAT rule - Brexit (+ accounting)

This 2 in 1 module deals with managing the tax news following Brexit with the United Kingdom (Northern Ireland, and Great Britain)But also includes a complete accounting part which allows to have the accounting reports with all the details on all the invoices.