New VAT rule - Brexit (+ accounting)

This 2 in 1 module deals with managing the tax news following Brexit with the United Kingdom (Northern Ireland, and Great Britain)

But also includes a complete accounting part which allows to have the accounting reports with all the details on all the invoices.

| Module version | 1.0.7 |

| Last update | 01/06/2021 |

| Compatible with PrestaShop 1.6 | Yes |

| Compatible with PrestaShop 1.7 | Yes |

Not only can you (must) respect the new tax rules following Brexit but this module allows you to have complete accounting, the results are saved in CSV format (usable with Excel)

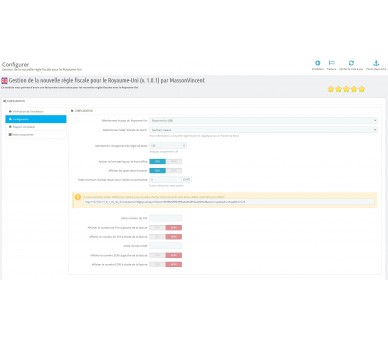

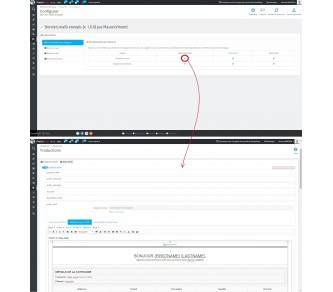

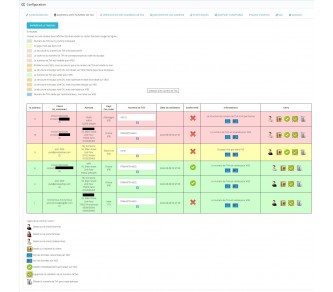

From the module configuration you can:

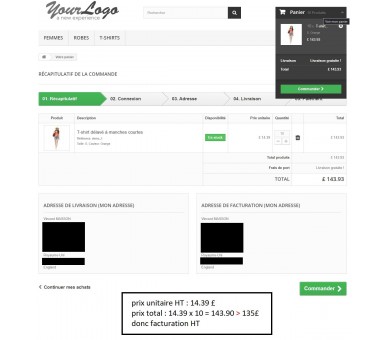

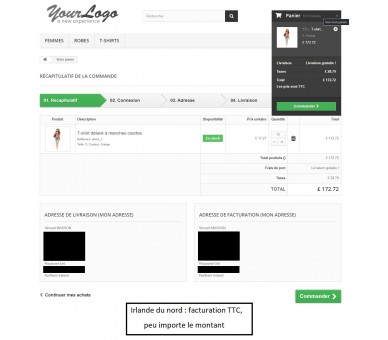

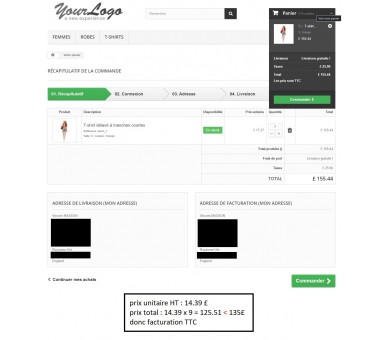

- select the new amount from which the rules change (today £ 135)

- activate or not the pound sterling on the front office

- display the amount of taxes in the shopping cart at the front office

- establish a minimum purchase (in £ HT)

- update the minimum purchase according to the € / £ price via a CRON task

- display your VAT number and your EORI number clearly visible on the invoice (either on the left or on the right)

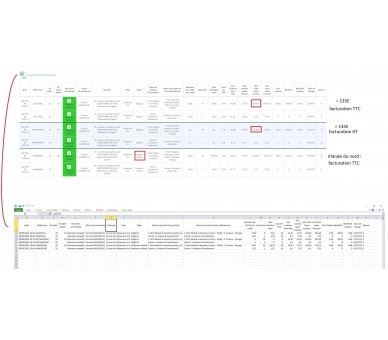

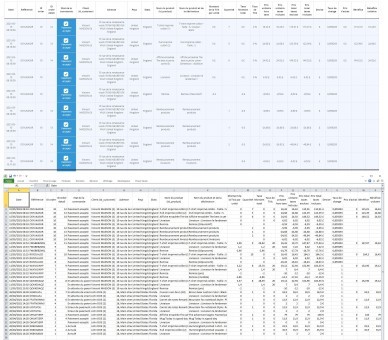

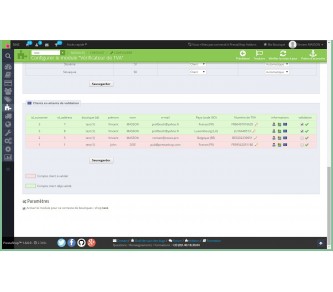

Accounting report:

- You can choose different settings:

- Choice of order status to display, these statuses are displayed in color with specific icons (native to PrestaShop)

- start and end date of the report

- shop choice

- possibility to use the point or the comma in the CSV results for non-integer numbers (example 12.34 or 12.34)

- display or not the virtual products

- display shipping costs

- display discount fees

- display product refund fees

- display shipping cost refunds

All values are displayed in the CSV file without the currency, making addition calculations easier.

Discounts and refunds are displayed with a negative sign in front of the value, so you can more easily make sums in the CSV file (Excel)

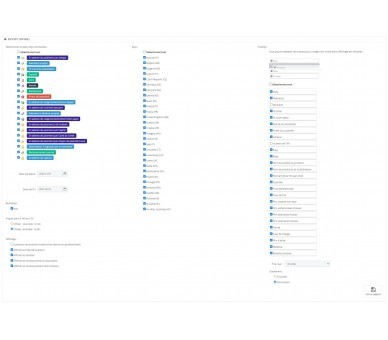

- Choice of countries

- Choice of fields to display, you can change the order with a simple click and drag:

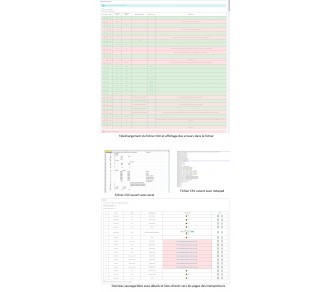

- reference,

- date of the order,

- name of the store,

- ID order

- ID order detail

- Order status

- Customer (last name, first name and customer id)

- Address (street, city, country)

- VAT number

- Country

- States (of the country)

- Product name (with id_product)

- Product name with declination

- VAT amount per unit

- Amount

- Total amount tax

- VAT rate

- Unit price excluding taxes

- Unit price taxes included

- Total price excluding taxes

- Total price including taxes

- Currency (in the back office the table displays the prices with the currency, but for Excel I have voluntarily removed the currency so that the data can be used to make sums for example)

- exchange rate (recorded at the time of the order, this rate may therefore vary depending on the orders)

- Buying price

- Profit (total price - purchase price)

- Unit profit (unit price - unit purchase price)

This data can be sorted not only by the field of your choice, but also in ascending or descending order.

You can therefore list the data by order ID (or date) in ascending order to send the CSV to your accountant.

You can also list products by unit profit in descending order to see the most profitable (first) and least profitable (last) products.

14 other products in the same category

SQL Backup (manual/CRON/mail)

This module allows you to make SQL backups very easily from the back office, but also by CRON task with sending a copy of the database (.sql.bz2 file) by email to the administrators of your choice

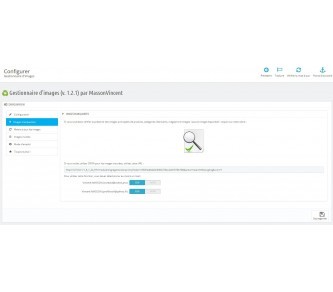

Product images in descriptions

This module makes it possible to improve SEO on Google by enriching the content of the description thanks to the figure and figcaption tags. It also improves rendering by zooming in on the image and specific customization possible for each image.

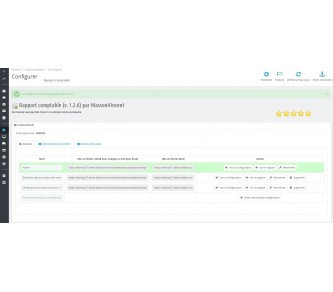

Accounting summary with VAT

This module allows you to have a complete accounting report, which not only allows you to give a CSV file listing the sales over a given period to your accountant,but also allows you to analyze your sales by sorting the data by profit, unit profit in order to see the most profitable and least profitable products

Intercept emails

Read sent emails (even locally), identify templates and personalize your emails very easily.

Delivery zones and postal codes

This module makes it possible to "divide" a country into new zones (regions, departments, postal codes ...) in order to allocate for each zone a specific carrier (or several) with a specific tariff.

Images and thumbnails: Compression and reSmush

Easily manage your product images, categories, manufacturers, suppliers and stores with this image manager. It will allow you to avoid storing unnecessary images, indicates if there are missing images and regenerates the images very quickly.

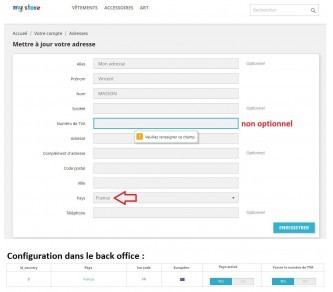

Force the VAT number depending on the country

This module allows you to force the customer to register their VAT number depending on the country, so you can force foreigners in your country to register their VAT number.

Login to customer account without password

This module allows you to connect to the customer account very easily without asking for his password. The connection can be made from the back office, but also from the front office.

Change of carrier

This module allows you to change the carrier from the back office and modify the cost of delivery.

Secure your shop!

Your shop has cost thousands of euros, it is your livelihood, so protect it! avoid any flaws, spam, SQL / XSS injections, backup the database and main files and monitor potential attacks

VAT number

Invoice tax-free foreign business customers who have a valid VAT number on VIES after verifying the VAT numbers to avoid VAT scams and customer errors.

Invoicing HT (without VAT) for pros (1.6 &...

This module allows you to invoice the groups of customers of your choice excluding VAT and to connect to customer accounts without knowing their password (superuser) in order to check the result.

VAT management and customer group by country...

This module will allow you to force or not the customer to enter their VAT number when registering or for customers déjas inscits. Once the VAT number indicated (and valid) the client can be chnage group according to its country of automatically or manually.

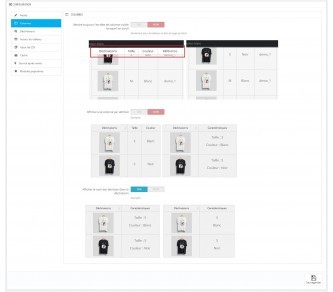

List of combinations

Display the list of variations on different pages to make more visible the richness of your products by the number of variations with the list of attributes, the image of each declination, a direct link to the declination and especially a button to add the declination directly into the cart !